Roth 401k early withdrawal calculator

It shares certain similarities with a traditional. Exceptions to the Early Withdrawal Penalty.

401k Calculator

Simply provide the required inputs variables and quickly calculator what your 401k will grow to in the future.

. 401K and other retirement plans. Strategy for Roth 401k to Roth IRA conversion and withdrawals. The IRS may waive the 60-day.

Roth IRA withdrawal and penalty rules vary depending on your age and how long youve had the account and other factors. Money goes in after taxes are paid. It may be tempting to pull money out of your 401k to cover a financial gap.

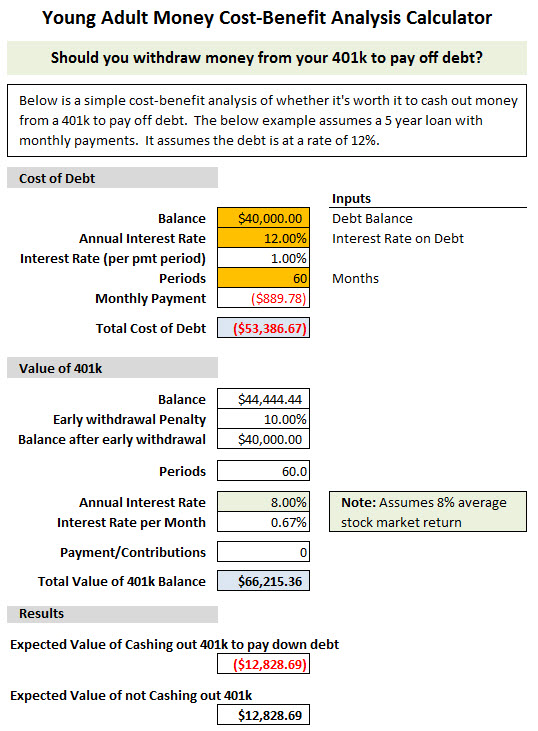

While you still have to pay taxes on any money taken out of a 401k or IRA before a certain age there are some circumstances that would let you get around the 10 early withdrawal penalty for retirement funds. Present Value of Annuity Calculator. Use our 401k Early Withdrawal Costs Calculator first.

Money goes in after taxes are paid which means that it wont reduce your annual taxable income. What is the after tax impact of switching from a traditional IRA to a Roth IRA. Not A Math Whiz.

Roth IRA Calculator. 401K Roth 401K Roth IRA or Traditional IRA. Or when you are considering rolling money over from a 401k to an IRA you may wish to roll over only a portion of your retirement savings and take the rest in cash.

If you return the cash to your IRA within 3 years you will not owe the tax payment. Individuals will have to pay income taxes on withdrawals though you can split the tax payment across up to 3 years. Withdrawals must be taken after age 59½.

You will be free to make a withdrawal from. If youre still saving for retirement you could also consider converting a portion of your 401k to a Roth IRA. This 401k Early Withdrawal Calculator will help you compare the consequences of taking a lump-sum distribution from your 401k or even your IRA versus rolling it over to a tax-deferred account.

Withdrawals must be taken after a five-year holding period. But do you know the true cost. How to avoid early.

Participants in a traditional or Roth 401k plan are not allowed to withdraw their funds until they reach age 59½ with the exception of. 401K Roth IRA Roth 401K - Need advice please. For example you wont have to pay the penalty if you take distributions from a 401k early for these reasons.

Your 401k is your money and making a withdrawal is as simple as contacting Fidelity to let them know you want it. Early 401k withdrawals will result in a penalty. Best age to take Social Security.

Find additional exceptions in the Form 5329 Instructions. Best and worst states for retirement. Consider a Roth IRA conversion.

It seems redundant to do the indirect transfer while you can do the direct transfer from 401k - roth IRA if the 401k plan allows to roll over to roth IRA. This simple 401k Calculator will show what role your 401k will play in plotting your path to your golden years. 401k Calculator - Estimate how your 401k account will grow over time.

Before making a Roth IRA withdrawal keep in mind the following guidelines to avoid a potential 10 early withdrawal penalty. Retirement Savings Calculator - Estimate how much you can save by the time you retire. If youre taking out funds from your retirement account prior to 59½ and the coronavirus exception or other exceptions dont apply use IRS Form 5329 to report the amount of 10 additional tax you owe on an early distribution or to claim an exception to the 10 additional tax.

The 401ks annual contribution limit of. Roth 401k contributions called a Designated Roth account. This can help set you up to be more tax.

With a Roth 401k income taxes only. Early withdrawal rules are very similar for both Roth 401ks and traditional 401ks. Making a Fidelity 401k Withdrawal.

These payments must last a minimum of 5 years or until you reach the normal 401k withdrawal age of 59 12 whichever is shorter. Early Withdrawal Costs Calculator. But you will not pay taxes on the amount when you.

A Roth 401k is an employer-sponsored retirement plan thats funded by after-tax dollars. You pay no tax when you withdraw it. Tax-free and penalty-free withdrawal on earnings can occur after the age of 59 ½.

Roth contribution withdrawals are generally tax- and penalty-free as long as the withdrawal occurs at least five years after the tax year in which you first made a Roth 401k contribution and. Roth 401k vs. Confused choosing between.

The easiest way is to simply visit Fidelitys website and request a check there. The rule of 55 which doesnt apply to traditional or Roth IRAs isnt the only way to get money from your retirement plan early. However you can also reach out via phone if you prefer.

With a traditional 401k you pay income taxes on any contributions and earnings you withdraw. Once you pay the income tax and early withdrawal penalty on your funds you are likely to only be left with about 60 of the money that you removed from your account. Free 401K calculator to plan and estimate a 401K balance and payout amount in retirement or help with early withdrawals or maximizing employer match.

The main difference is the income taxes you pay on your contributions. Why do you do 401k - traditional IRA - Roth IRA instead of straight 401k - Roth IRA. You will owe tax on the amount of your Roth conversion in the year that you convert but you likely wont owe any additional taxes during your lifetime.

Exceptions for Both 401k and IRA. Annuity Calculator - Like the Retirement Withdrawal Calculator except that you enter the years you want the nest egg to last and it calculates the withdrawal amount. Minus any non-deductible contributions will be taxable in the year received.

You can find out how much your 401k will grow without the help of a financial wizard. Traditional 401k Withdrawal Rules. The 2 trillion CARES Act wavied the 10 penalty on early withdrawals from IRAs for up to 100000 for individuals impacted by coronavirus.

You die or become permanently disabled. Assuming i am happy with my current 401k low manegement fee 0019 ish with good performance. On top of that the IRS will assess a 10 early distribution tax penalty and the conversion will ultimately not take place.

Birth or adoption expenses New parents can now withdraw up to 5000 from a retirement account to pay for birth andor adoption expenses penalty-free. The Roth 401k brings together the best of a 401k and the much-loved Roth IRA. All of the gain is tax-free.

You can avoid an early withdrawal penalty if you use the funds to pay unreimbursed medical expenses that are more than 75 of your adjusted gross income AGI. Call 800-343-3543 with any questions about the process.

401k Calculator Withdrawal Shop 57 Off Www Ingeniovirtual Com

401k Calculator Withdrawal Shop 57 Off Www Ingeniovirtual Com

Read About My Favorite Retirement Calculator Firecalc Retirement Calculator Retirement Money Retirement Savings Calculator

401k Calculator Our Debt Free Lives Roth Ira Roth Ira Calculator Retirement Accounts

Download Traditional Vs Roth Ira Calculator In Excel Exceldatapro

401k Calculator Withdrawal Shop 57 Off Www Ingeniovirtual Com

401k Calculator Withdrawal Shop 57 Off Www Ingeniovirtual Com

The Ultimate Roth 401 K Guide District Capital Management

Pin On Financial Independence App

/thinkstockphotos-152173891-5bfc353d46e0fb0051bfa959.jpg)

How To Calculate Early Withdrawal Penalties On A 401 K Account

401k Retirement Withdrawal Calculator Clearance 50 Off Www Ingeniovirtual Com

401k Tips For Beginners Financial Coach Saving For Retirement Retirement Savings Plan

Average 401 K Account Balance By Age Vs Recommended Balances For A Comfortable R Retirement Planning Finance Average Retirement Savings Saving For Retirement

Safe Withdrawal Rate For Early Retirees 401k Withdrawal Retirement Calculator How To Plan

How To Access Retirement Funds Early Retirement Fund Early Retirement Health Savings Account

401k Retirement Withdrawal Calculator Clearance 50 Off Www Ingeniovirtual Com

Fidelity S Retirement Calculators Can Help You Plan Your Retirement Income Savings And Assess Your Financial Health Fidelity